You’ve likely heard the news that Silicon Valley Bank (SVB) has experienced a financial shock. In a matter of a few short days, Silicon Valley Bank lost its funds and went under. So, let’s get into the facts that can help put this event into context.

The Series of Events

Before interest rates started to rise, SVB, a large and respected bank primarily for tech companies and startups, had lots of cash on hand. As a result, SVB reinvested its cash into long-term US treasury bonds.

As interest rates started to rise, the value of those long-term bonds diminished given that they were bought when rates were low. At the same time, many of SVB’s tech clients experienced downturns in revenue and began withdrawing cash to run their businesses.

To help supply the cash needed for those companies, SVB needed to raise capital. After considering their options, they issued a sale of their treasury bonds. But because their value was so largely diminished, given that the same long-term treasuries could be bought with much higher interest rates elsewhere, the sale of those treasuries turned into a major loss.

Subsequently, SVB’s parent company, Silicon Valley Financial Group, saw their stock (NASDAQ: SIVB) dip more than 50% on Thursday morning, March 9th, 2023. As a result, and due to the fact that, like many large bank accounts, most of SVB’s funds were not covered by the FDIC (Federal Deposit Insurance Corporation), other venture capital firms and tech companies panicked, yanking their funds due to the stock loss.

By the next day, Friday, Silicon Valley Bank announced its insolvency.

The Bigger Picture: How Do Banks Work?

Banks typically have 10% of their deposits in reserve for when people or institutions make withdrawals. The rest is lent out, which is what grants you the interest rate you receive on your savings accounts, for example. Historically, this balance works well, but when people lose faith in their banks, more people request withdrawals amounting to more than the 10% available, putting pressure on the bank and in some cases, causing bank failures.

Banking Insurance

The good news is your bank funds are often covered under FDIC insurance. Banks pay a premium to the FDIC to cover bank accounts of up to $250,000 per account. If the whole banking sector experiences bank runs and the FDIC can’t cover insured amounts, the Federal government usually steps in to support the FDIC as well.

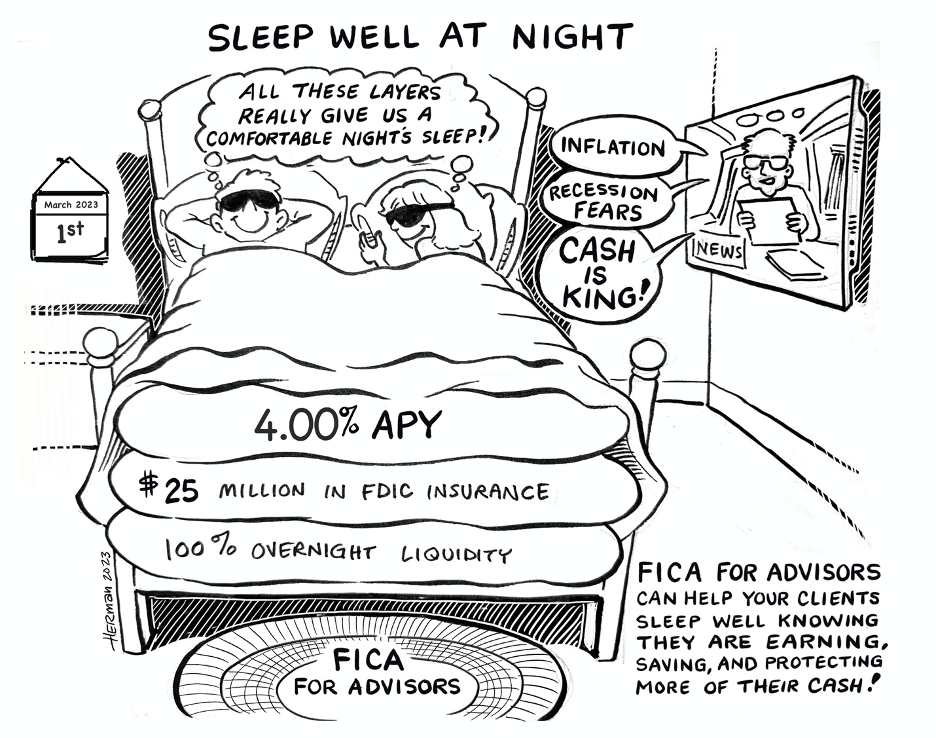

If you have bank accounts covered by the FDIC of under $250,000 (or $500,000 for a jointly owned account with your spouse), your money is legally insured from a potential bank failure. If you’re looking for higher FDIC insurance of up to $25,000,000 we have an option available to those we work with.

IRAs, trusts, and other accounts are also subject to limits on coverage amounts. However, the Electronic Deposit Insurance Estimator (EDIE) from the FDIC can simplify the process of checking if your deposits are eligible for government deposit insurance.

Original artwork by Philip Herman, full rights to StoneCastle

Other Forms of Financial Insurance

It’s important to note that deposit insurance doesn’t protect all financial products. Only certain ones such as checking accounts, savings accounts, money market accounts, certificates of deposit (CD’s), cashier’s checks, and money orders are covered. Stocks, bonds, mutual funds, Treasury securities, life insurance, annuities, and items held in safe deposit boxes are not included in deposit insurance coverage.

If you use your bank’s brokerage service to buy mutual funds and the brokerage fails, you won’t be protected by federal deposit insurance. However, the SIPC (Securities Investor Protection Corporation) offers insurance protection for investors and may supply up to $500,000 in coverage for your brokerage account if your broker fails. However, the SIPC does not cover speculative losses such as a decrease in the value of equity you own in stocks, for example.

The Most Important Aspect: Your Funds

Several factors such as your account type and balance may affect the level of protection your money receives. In most cases, keeping your money in the bank is a secure option, even during times of economic hardship. Nonetheless, if you have questions or concerns about your exposure to potential fallout from recent events, please reach out and we’ll schedule a call right away to help answer your questions and concerns.

APY as of 03/01/2023, is not tiered, net of fees, and subject to change.

https://www.wsj.com/articles/silicon-valley-bank-svb-financial-what-is-happening-299e9b65

https://www.theverge.com/23635692/silicon-valley-bank-svb-collapse-explainer-startups-venture-capital

https://hermoney.com/banking-2/what-happened-at-silicon-valley-bank-in-plain-english/

https://www.cnbc.com/2023/03/12/stock-market-futures-open-to-close-news.html

https://www.bloomberg.com/news/articles/2023-03-10/what-is-happening-to-svb-bank-run-fear-spreads-as-stock-tumbles

https://www.cnbc.com/2023/03/10/silicon-valley-bank-collapse-how-it-happened.html

https://www.cnn.com/2023/03/10/investing/svb-bank/index.html

https://larrykotlikoff.substack.com/p/why-svbs-failure-is-really-scary